Dentsu Aegis Network: 2019 Advertising Spend Forecast Report

Digital ad spend will go up +12.5% in 2019 in line with global increase, while decline in newspapers (-25%) and magazines (-9%) far exceeds developed economies average

Entertainment and web services register very high growth rates in 2018 and pharmaceuticals lead national spend.

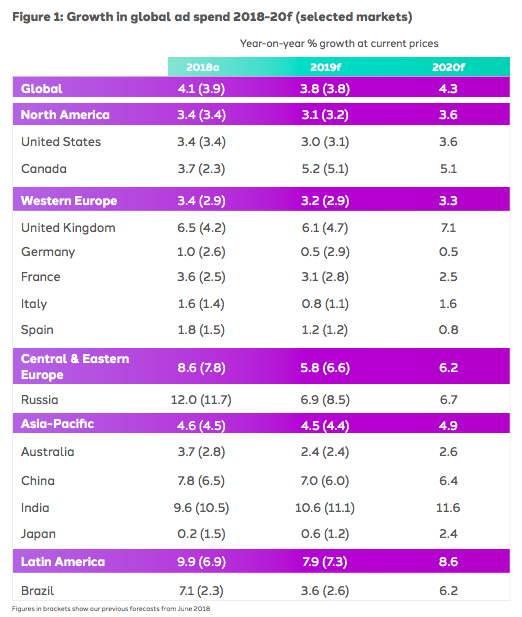

Dentsu Aegis Network’s latest advertising spend forecast, based on data from 59 markets, predicts global growth will reach +3.8% in 2019, following +4.1% in 2018, taking total investment to US$625 billion. Geographically, Asia Pacific and North America will be the major growth regions next year, contributing 42% and 30% of the global increase respectively. Western Europe accounts for 15%, with Latin America at 10% and Central and Eastern Europe 4%.

Advertising spend growth in China for 2019 is projected to be 7% and take total investment to 717 bn RMB fuelled by the continued expansion of domestic consumption and middle classes. Digital and OOH (digital), which rose +15.8% and +14.2% respectively in the first three quarters of the year, will remain the key driving forces in 2019.

Investments have evolved as China shifts from an export-driven economy to a consumer-centric society. Additionally, ad spend is following consumers in response to their increased disposable income, consumption habits and media behaviours. Consumption accounted for 78 percent of China's GDP growth during the first three quarters, an increase of 14 percentage points over the same period last year, as residents' per capita consumption registered a nominal increase of 8.5%.

In 2018, Pharmaceuticals topped the ad spend industry ranking with over 125 bn RMB. Entertainment (59.60%) and Web Services (52.70%) are the fastest-growth sectors, while Real Estate showed the largest decline, with a -34.93% y-o-y drop.

Media Trends in China

DIGITAL: Fundamental behavioural changes drive speedy growth

Generation “Z” became adults in 2017/2018 and their consumption habits have greatly impacted the mainstream. These young adults in lower tier cities have formed their own unique consumption needs and habits. Regarding e-Commerce, product range and depth of choices continues to attract consumers and driver advertisers to invest online. Also, China is more mobile than ever. It is continuously growing and is expected to account for 75.80% of the total digital market in 2019.

TV: Advertisers shift budget to Online TV and product placement

Smart TVs have become increasingly popular as their price continues to drop. Online TV / OTT content is becoming more abundant and paid viewing habits are becoming more widely accepted by audiences. TV spend will continue to focus on CCTV and prime satellite TV channels.

OOH: The wind of change continues to blow

OOH market will continue to develop steadily. Several big media vendors are consolidating to expand their OOH advertising resources as new digital OOH media is expected to break into the market. As coverage and quality of OOH advertising improves, advertisers will continue to spend on OOH, however, the investment threshold will also be higher than before. Smarter tech in OOH will see a shift to delivering precision targeting at scale and the use of telecom data will enable greater tracking of reach and effectiveness of outdoor campaigns.

PRINT: Sharp decline vs global average

The ad revenue structure of newspapers is generally traditional as well as the interaction with clients and readers. However, after years of integrating their content with digital resources, some publications have cumulated rich expertise in creating offline branded events to attract advertisers for sponsorship. Some have deployed AR & VR technologies to enhance consumers experience.

RADIO: Flat growth

Radio will remain stable as car ownership continues to increase year on year.

Global trends

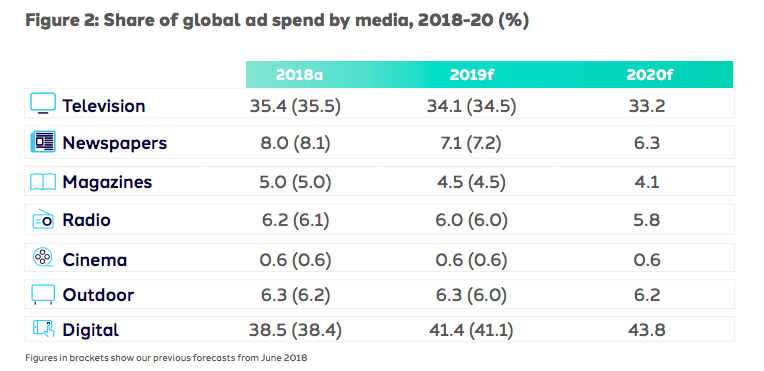

Digital ad spend to grow by +12.0% in 2019 to reach US$254 billion and 41% of global share. Digital will be the leading channel in 26 of 59 markets analysed, with the US, Japan, Czech Republic, Malaysia and Singapore joining this list for the first time.

Strong growth on mobile continues (+19.2%) with video particularly strong (+20.0%), driven by viewing on mobile devices and the growing popularity of catch up. Social media growth forecast to remain strong in 2019 (+18.4%), despite brand safety and privacy concerns.

Programmatic forecast to grow +19.2% in 2019 as the model starts to be adopted across other media e.g. TV, DOOH.

TV ad-spend is forecast to grow +0.5% in the face of competition from video-on-demand services such as Netflix. However, TV continues to innovate – particularly in the US – through ad-formats, reduced ad loads and attribution solutions.

Radio is forecast to grow +1.1% in 2019 to reach US$37 billion - 6.0% of total spend. Fast-growing technologies such as voice assistants and smart speakers are expected to push the usage of audio.

Traditional print continues to decline (Newspapers -7.2% and Magazines -7.0% in 2019) as the focus moves to digital.

Out of Home continues to grow (+4.0% in 2019) to reach 6.3% share, with growth driven by DOOH.

Market trends

Asia Pacific and North America forecast to contribute 42% and 30% of the global increase respectively. Western Europe will grow by 15% with Latin America at 10% and Central and Eastern Europe 4%.

United States: Growth forecast at +3.0% in 2019 to reach US$223.6 billion, with digital forecast to overtake TV ad-spend for the first time. Linear TV under pressure with no major events, such as elections or Olympics, affecting spend and audience ratings putting pressure on price. Digital ad spend continues to grow (+12.3%) powered by mobile as time spent on devices continues to rise.

UK: Resilient growth forecast at +6.1% in 2019 to reach £22.2 billion. Digital continues to drive the UK market with +10.9% growth forecast in 2019 and the world’s highest share of digital spend (64%). Concerns around the impact of Brexit and the general data protection regulation (GDPR) have yet to manifest in falling advertiser confidence.

0 个评论